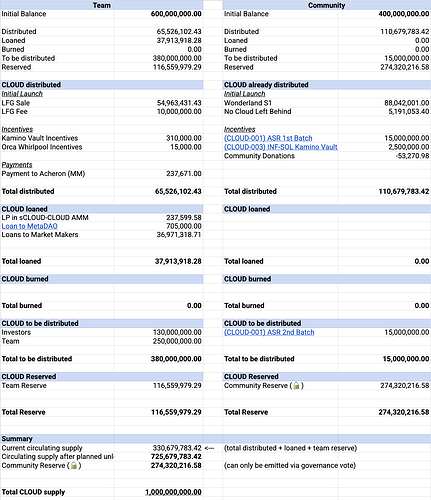

CLOUD Internal Audit Report 2025-06-18

We have recently completed an internal audit accounting for every single token movement from token genesis. We think it’s important to be transparent, because transparency builds trust, and trust builds long-term alignment.

Key findings:

- Total supply: 1,000,000,000 CLOUD

- Current circulating supply: 330,679,783.42 CLOUD (33.07%)

- All movements of CLOUD from Team and Community wallets are accounted for.

- No tokens were sold outside of the initial launch pool.

Below we summarise how CLOUD was distributed at genesis, how CLOUD has been distributed so far, and planned future distribution of CLOUD.

CLOUD distributed

The initial launch had two components: Wonderland S1 and LFG. Altogether, 158,196,485.83 CLOUD was distributed via the launch. The breakdown is as follows:

- 88,042,001.00 CLOUD distributed in the initial airdrop;

- 54,963,431.43 CLOUD distributed via Jupiter’s LFG Pool;

- 10,000,000.00 CLOUD distributed via Jupiter’s LFG fee;

- 5,191,053.40 CLOUD distributed via No Cloud Left Behind.

Incentives

The team decided to fund some initial incentives from the Team Reserve.

- 310,000.00 CLOUD was distributed as Kamino incentives;

- 15,000.00 CLOUD was distributed as Orca Whirlpool incentives.

With the introduction of Sanctum Governance, the community voted to fund both Active Staking Rewards (CLOUD-001) and incentives for INF-SOL Kamino Vault (CLOUD-003).

- 15,000,000.00 CLOUD was distributed to CLOUD stakers as Active Staking Rewards (ASR);

- 2,500,000.00 CLOUD was distributed as incentives in an INF-SOL Kamino vault.

Payments

Initially, the team decided to pay one of our market makers half in stablecoins and half in CLOUD. This has since stopped: the team now pays our market makers entirely in stablecoins.

- 237,671.00 CLOUD was distributed to a market maker as payment for services.

CLOUD loaned

The team has loaned CLOUD out exclusively for market-making purposes.

- 36,971,318.71 CLOUD was loaned out to market makers to market make on CEX and DEX venues. (Note that these loans are made exclusively on retainer, not a loan-and-call-option model. This means that the CLOUD will always remain in the possession of the team.)

- 705,000.00 CLOUD was loaned out to MetaDAO as seed liquidity for new governance proposals.

- 237,599.58 CLOUD was deployed into an sCLOUD-CLOUD AMM to facilitate working futarchic markets for new governance proposals.

CLOUD burned

No CLOUD has been burned yet.

CLOUD to be distributed

- 250,000,000.00 CLOUD will be distributed to the team.

- 130,000,000.00 CLOUD will be distributed to investors.

- 15,000,000.00 CLOUD will be distributed to CLOUD stakers as Active Staking Rewards (ASR).

Team and investor CLOUD is currently locked and will be distributed over a 24 month period starting July 2025.

The next ASR will be distributed in August 2025.

There are no other future CLOUD distributions planned.

CLOUD Reserve

There are two CLOUD Reserves: the Team Reserve (controlled by the team) and the Community Reserve (controlled by governance).

The team reserves the right to distribute tokens from the Team Reserve. As of today, however, the team has not sold any tokens from the Team Reserve.

CLOUD in the Community Reserve is locked indefinitely and can only be distributed via a successful governance vote like CLOUD-001 and CLOUD-003.

For an exhaustive list of all CLOUD movements since token genesis, see the following spreadsheet:

CLOUD Audit 2025-06-17.xlsx

All CLOUD is accounted for.

Special Remarks:

- Due to a mistake we made with initialising the initial ASR distribution, the team had to temporarily loan 14,998,379.05 CLOUD from Team to Community. In August, this amount will be claimed back into the Team Reserve.

- The Community Reserve has received CLOUD donations from community members over the past year, most notably for a community-funded Bounty Contest. Some of this was earmarked and distributed to community members, but overall, the Community Reserve has grown by 53,270.98 CLOUD.